One of the biggest great things about a keen FHA loan is the low down commission needs. While most conventional money require no less than 20% down, FHA only needs a minimum of step 3.5% down payment. This really is particularly ideal for loans Copper Mountain very first-date people features a small savings.

*Note: earnings eligible first-big date people in the Fl actually have the Hometown Heroes System option to own deposit and you may settlement costs advice. People is learn more about Florida Hometown Heroes qualifying right here.

Another advantage of FHA finance is that they promote competitive rates of interest compared to almost every other mortgage choice. This may cut individuals thousands of dollars along the longevity of its mortgage.

FHA money also have zero prepayment punishment, meaning borrowers will pay of or refinance its home loan at any day instead of a lot more fees. Thus giving home owners alot more flexibility and you may command over their cash. Furthermore, FHA loans give individuals solutions, such repaired-speed mortgage loans and you may adjustable-rates mortgage loans.

Residential property inside the Florida will still be pretty cheap in comparison to of many other says regarding northern otherwise away western. Quite often, the cost purchasing instead of the cost to help you lease prefers to acquire. 2nd, FHA home loan pricing continue to be down and purchasing commonly features masters more than renting.

Qualifying To possess FHA Finance for the Fl:

Like other most other mortgage programs today, taking acknowledged to have an enthusiastic FHA mortgage in the very based borrowing from the bank, employment history and obligations ratios. Obviously, the biggest challenge for many is the picking out the newest needed deposit. Really, you will find promise because of the of numerous down payment advice applications available today.

Though Florida FHA recommendations you should never county the very least score demands, most lenders wanted your center score become about 620 to the restriction 96.5% capital. People will even all the way down credit scores right down to 580 can frequently end up being accepted which have a heightened advance payment of 5%-10%. There are even even more standards in position when it comes to FHA consumers who’ve had a personal bankruptcy, quick sale, or foreclosures over the last five years.

Besides that, the only most other situation FHA means is a couple of discover trading outlines indicating which you have paid back on time for around 12 days. Unlock change traces could be handmade cards, auto costs, figuratively speaking, etcetera. And you will speaking of college loans, we would like to be sure to is actually most recent for the all Federal loans is qualified to receive an enthusiastic FHA mortgage.

Since i had the fundamentals out of the way, why don’t we mention a career history. FHA often permit consumers to move ranging from efforts as long as there isn’t any unexplained offered holes from inside the employment.

Can you imagine you behave as a nurse from the since the health, and you also recently turned employers to another health. You also chose to simply take a two-day break before starting the latest business. This could be let and you can felt regular.

But not, if you were unemployed having months, you need to be happy to explain the gap off employment. Longer openings away from employment could possibly be the outcome of numerous things, for example problems, proper care of a family member, an such like.

Let’s discuss the necessary FHA loan downpayment. If you were to explore a traditional loan, you’d need as much as 5% minimum down payment. Towards an effective $300,000 mortgage, which is $fifteen,000 As well as your settlement costs. That have a beneficial FHA mortgage, you simply lay step three.5% down otherwise $ten,five-hundred.

Likewise, your own FHA mortgage advance payment would be gifted because of the a relative, or if you acquire it from the 401k. Truly the only place it can’t come from ‘s the vendor, but that is usually easy due to the fact FHA allows the vendor to invest to six% to possess settlement costs (and you will closing costs is actually hardly more regarding the 5%)

Fl FHA Financing Highlights Include:

- Low step 3.5% deposit *Possibly 100% capital having approved down payment assistance apps into the Florida

- Lower mortgage insurance fees

- Down credit scores let

- Household seller allowed to spend consumer’s closing costs

- Financing restrictions off $498,257 (1-equipment possessions) for the majority of of Fl inside 2024 *Particular areas encompassing Jacksonville, Miami, Tampa, Western Palm, Key West, etcetera, can be higher. Please find the done state because of the state FHA financing limit chart less than.

- Reduced fixed rates of interest, 15-yr and 31-yr words

- Not limited to basic-go out homebuyers, move-right up consumers is actually greet

- Versatile FHA streamline re-finance choice

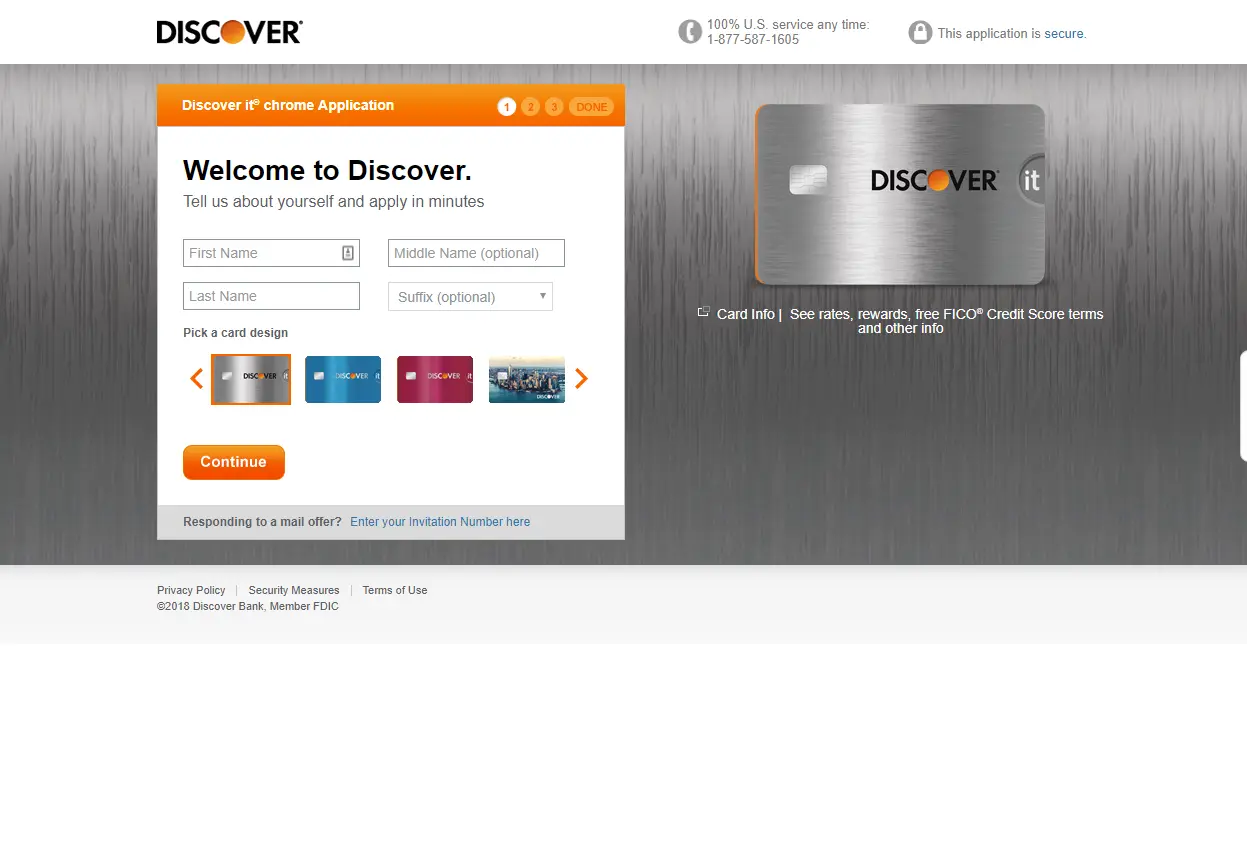

Happy to start the process? Please affect all of us today to get the FHA pre-acceptance come. E mail us all week long by the getting in touch with the amount over, or fill in the knowledge Demand Mode in this post.