If you want to recover the individuals can cost you, and additionally a few of your own completely new outlay, you will need to waiting 6 months thereby applying for a standard cash-away re-finance

— Merely the order and closing costs are funded in put off investment different. One will set you back obtain so you can redesign the home cannot be incorporated.

— The acquisition need come a keen arm’s-size deal in which the customer and you will vendor one another acted within the her individual welfare.

— The reason out of funds to suit your cash contract should be recorded having bank comments, personal loan records or a loan with the a new property you own. One financing, together with house equity lines of credit, put as a source of money into buy have to be reduced from the proceeds from the new defer resource difference.

— Gift loans may be used as the a way to obtain cash. If the currency Mom and dad gave you really must be repaid, this is simply not a gift; instead, its that loan that has to additionally be paid back about defer refi continues.

— There is no outstanding liens to your property, very ensure that your taxes, insurance and you will property owners association dues was paid up.

Shortly after an emergency Effects

These days, calamities such as wildfires, tornadoes, flooding and you will hurricanes much more strong — and a lot more frequent — than ever before. It is much more possible that regardless of where https://paydayloancolorado.net/southern-ute/ you live, your home could be struck one way or another.

You already know it’s crucial to be equipped for such as for example an enthusiastic disaster, exactly what goes a while later is really as crucial.

The initial step, each the fresh new nonprofit Consumers’ Checkbook, is always to evaluate your residence and take any needed methods in order to end then damage. When the a falling forest lay a hole in your roof, such as for example, create a good tarp when it is safe to help you exercise. If you don’t, then injury to household that were unharmed throughout the modern experiences is almost certainly not included in the insurance provider.

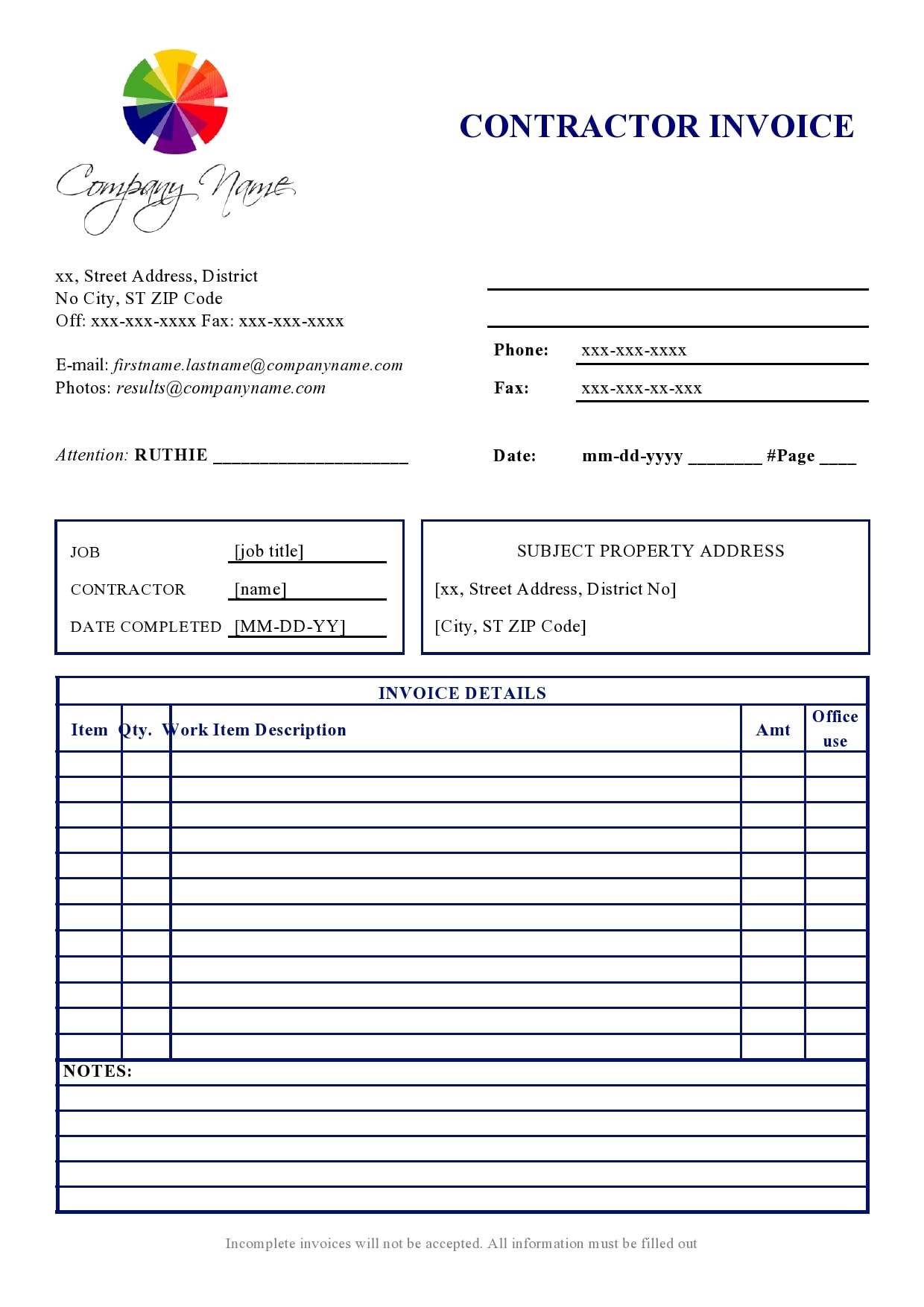

Next, simply take photos or movies of one’s destroy, whether it is the dwelling, their residential property or both. Need just how that which you appears on immediate aftermath prior to beginning to clean and fix busted factors. Consumers’ Checkbook suggests individuals to not throw away one thing up to an enthusiastic insurance coverage adjuster has examined they, and also to continue invoices for any expenditures. Very formula safety people can cost you.

Prior to signing a contract, make sure the masters was licensed and you will bonded. If you possess the go out, glance at the records.

Avoid fly-by-night designers who work out of their automobiles, make rash quotes and you may demand half of the money beforehand. These types of storm-chasers might do a little really works, however, always would not end — instead, they will certainly try to escape out of town to a higher crisis, making unhappy people within their aftermath.

«Withhold as often fee that you could» through to the tasks are over, advises a review of brand new Consumers’ Checkbook website (checkbook.org). «In the event the fix tasks are thorough, the fresh specialist could possibly get inquire about unexpected limited payments . however, zero legitimate company is to demand complete fee ahead of time.

After you’ve safeguarded your house, telephone call the insurer in order to file a declare. Of many insurance providers features disaster gadgets you to swarm towards affected regions so you can help their customers when a disaster happen. But show patience: They can be overloaded with people in the area, and so they will do the poor cases very first.

In the event that adjuster appears, the insurance Suggestions Institute (III) says, has a summary of damaged points prepared to demonstrate to them, and explain one structural ruin. In order to substantiate your losses, give any invoices which you still have — just generate copies ones very first.