Are you aware you can take out a house collateral financing on the accommodations assets in Tx which you very own? It’s a great way to leverage the significance you based more many years of mortgage payments. It is an economical cure for and obtain a special, low-rates mortgage. Very, realize our very own help guide to find out more about they.

Published by Victor Steffen

Winner Steffen are an experienced Agent and you may a property investor in the main Colorado with many years of sense as well as over 130 marketing closed within the last 1 year.

Household Equity Finance

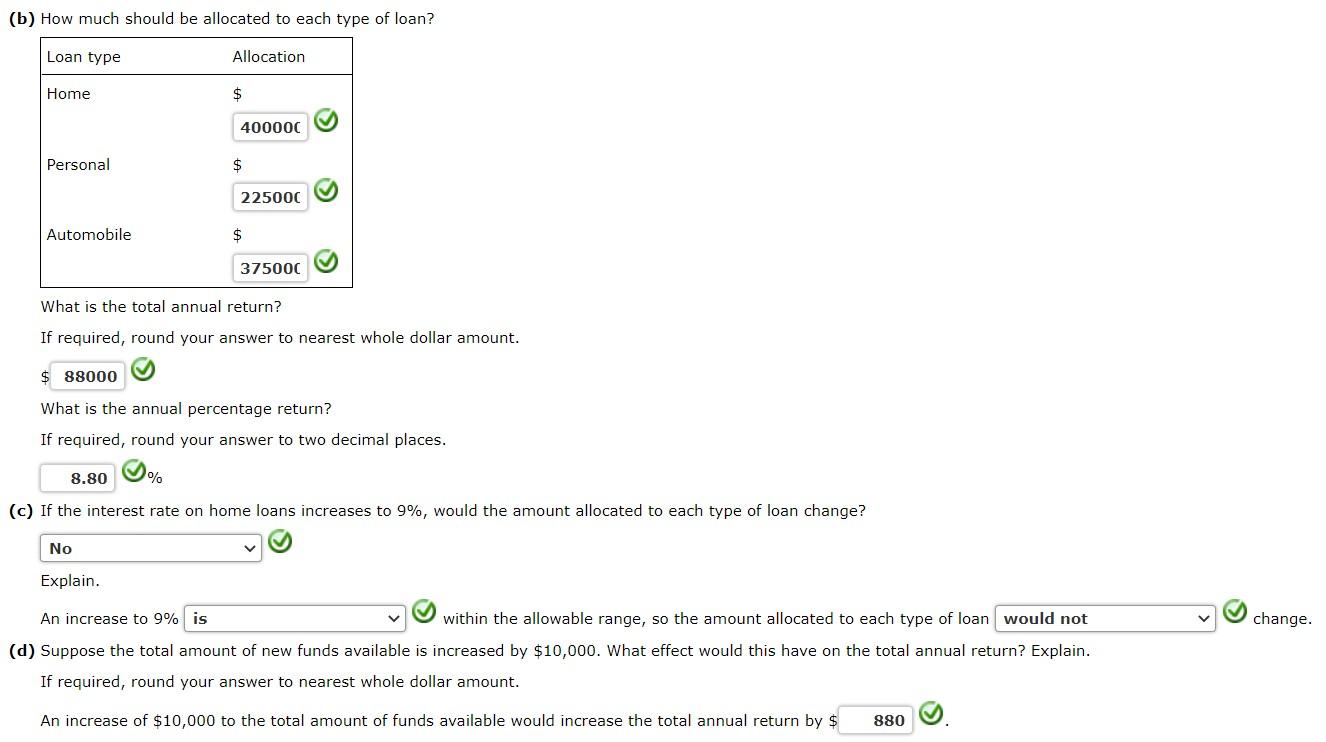

A house guarantee loan was a method to benefit visit homepage from the latest worth of your house. Essentially, you borrow against all round property value your home, without an excellent home loan amount owed. When it comes to domestic security money for the resource qualities in Tx, you can obtain as much as 80% of the complete value of the property in question. But it takes specific searching to acquire loan providers ready to grant a house collateral financing on the accommodations property. The capital your raise can be used for next opportunities otherwise getting intentions including domestic enhancements otherwise debt consolidation reduction.

A home equity mortgage differs from a property Equity Collection of Credit (HELOC). A good HELOC was a line of credit which have a fixed or adjustable speed which is safeguarded against the domestic alone otherwise the security. Borrowers normally withdraw money from that it line of credit up to a fixed restriction, popularly known as a blow. At the same time, a house security loan comes in complete and certainly will feel utilized according to borrower’s discretion.

When you take away home collateral financing into the money properties in the Colorado, it is very important know the applicable rules. These types of guidelines can assist your when you look at the believed and determining the suitable timing to possess with the equity regarding a residential property.

- Youre simply for a maximum of 80% of property’s security. For example, in case the investment was valued within $two hundred,000 along with zero a great home loan, you can use around $160,000. But not, for people who still have $sixty,000 a good, the most you could get might possibly be $100,000.

- Keep in mind that you could potentially only have one to equity mortgage at once. If you want to receive a new financing, you should basic pay off current one. Believed is essential, and we will help you along with your strategy.

- At exactly the same time, youre allowed to pull out only 1 equity financing contained in this a great a dozen-day several months. Even if you provides paid off the original loan, you can’t submit an application for another guarantee loan up until one year provides elapsed.

- Take note you to definitely finance can not be closed in this 12 days of implementing as a result of the first criteria of fact-examining. Loan acceptance usually takes no less than a month, but we might manage to assist facilitate the method.

Its worthy of mentioning a large number of lenders in Colorado dont provide domestic guarantee funds towards resource features due to the related top of exposure. Therefore, it can be easier for you to help you borrow secured on the fresh collateral of the first quarters, probably securing a lesser interest rate along the way. Feel free to contact us to own suggestions about looking for trader-friendly lenders who can help you.

Both% Rule Inside the Colorado

To possess a home collateral loan on an investment property into the Tx, loan providers are limited by charging you a total of dos% of your own amount borrowed in the costs. It is important to observe that this won’t tend to be charges related with:

- Surveys

- Appraisals

- Headings

Lenders are obligated to present an enthusiastic itemized variety of all the charges, activities, prominent, and focus they’ll be billing with the financing. It should be done zero afterwards compared to go out till the closure. Because debtor, there is the to waive that it requirements, nevertheless should provide composed consent.