It is no wonder the sunrays and delightful shores is an average benefits associated with located in hot weather condition. But did you know becoming a citizen from inside the Florida has actually maybe generated your richer?

According to most recent Freddie Mac computer domestic rate index report, Fl homeowners’ home values have increased by the more 81% inside 5 years. So if you try thinking if it’s value performing an excellent cash-aside refinance? It simply was!

Prior to you tap into your property guarantee, its essential to understand that it economic choice and how refinancing performs prior to taking this new dive.

There are various advantageous assets to refinancing your house financial, however, there are also specific downsides. Keep reading, Cash out Refinancing: Benefits and drawbacks Explained to higher see your re-finance options.

Economic Considerations of money-Out Refinancing

The decision to create an earnings-out refinance shouldn’t be entered with the lightly. You must carefully evaluate your existing finances. It is critical to remember that a finances-away refinance are effectively taking out fully another home loan.

In this instance, you no longer have your brand spanking new home loan, but yet another home loan and interest rate. You will find a rise in the entire loan amount, and you can another payment are required.

The length of time it will take to re-finance your house depends for the exactly how prepared youre. Before beginning the applying process to possess a money-out refinance, definitely look at the following:

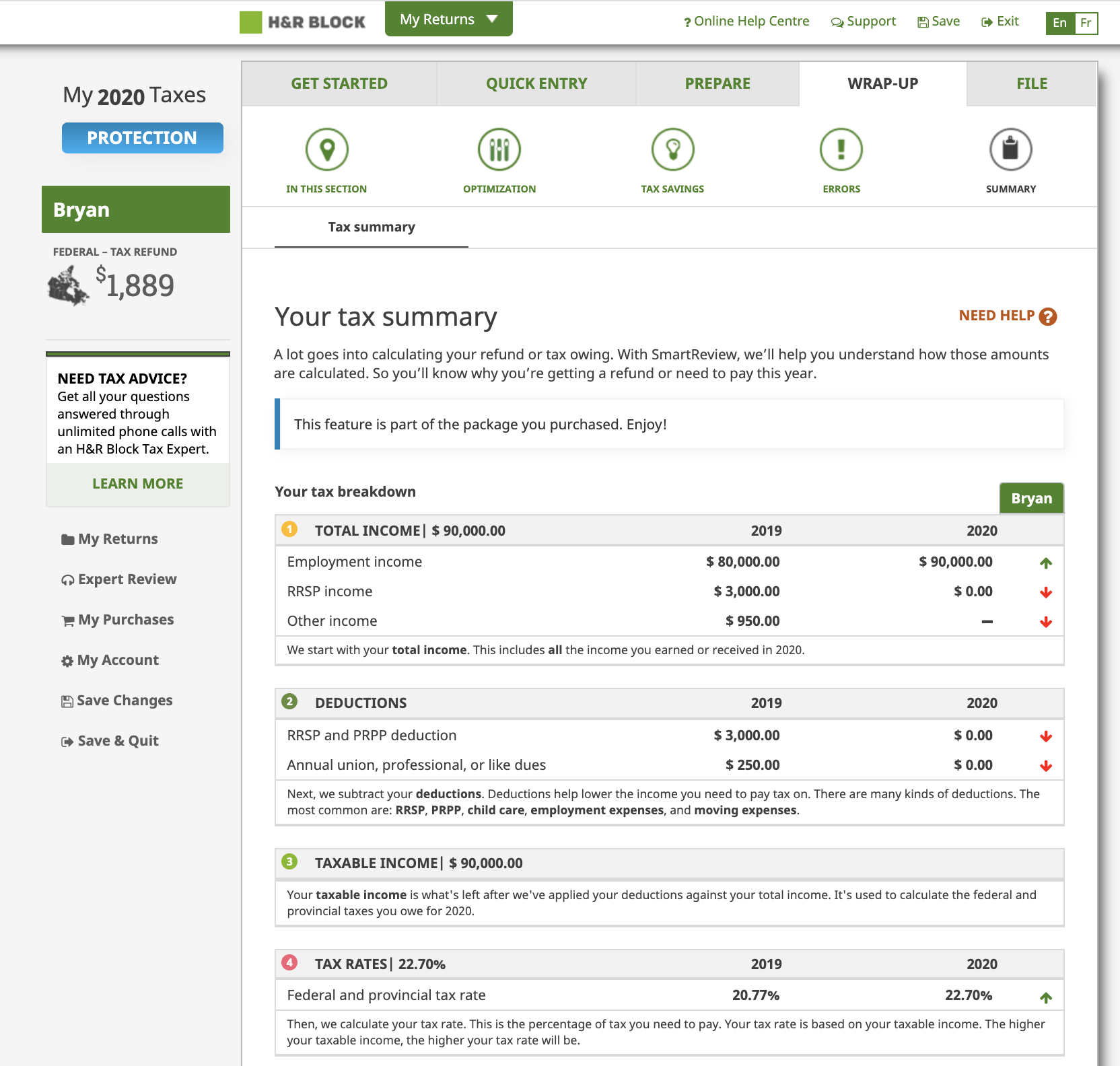

- Credit history:

- Debt-to-earnings proportion (DTI)

Loan providers generally require the very least 620 credit history having antique and you can Va finance. Although not, FHA financing require a good 580 credit rating. Just remember that , credit rating requirements may differ depending on the bank.

Quite often, you have a personal debt-to-Earnings proportion (DTI) lower than 40%. It’s important to note that DTI criteria differ by lender. Certain loan providers enable an earnings-away refinance that have around a great 50% DTI.

Accessibility Dollars

A funds-aside refinance is an excellent way to get plenty of cash you need to use for other aim. Lenders usually wanted that loan-to-value ratio from 80% or reduced to own a finances-aside refinance.

As a result make an effort to have at the least 20% equity of your house in order to qualify. When you have collected extreme security of your home, an earnings-out re-finance can be a terrific way to accessibility the money you prefer.

Improve Property value Your home

A funds-aside refinance permits you access to your house security. You could add tall really worth to your home with a cooking area restoration otherwise incorporating a different bathroom. These renovations can boost the worth of your home.

Simultaneously, when you use the newest continues of your dollars-away re-finance for renovations, you can take advantage of an income tax deduction.

Lower Rates of interest

Refinancing your home loan can get save some costs with a brand new straight down interest. A predetermined rate with a 30-season home loan provides a stable payment per month and no unexpected situations. Signature loans and handmade cards has actually varying interest rates.

Enough time Installment Period

Their fees term to have good refinanced home loan can be 31 age. Conversely, personal loans constantly last anywhere between twelve and you can 60 weeks. Some loan providers can offer eight years for personal loan payments.

Taxation Write-offs

A home improve otherwise money financing, such as for instance updating window so you’re able to opportunity-productive of them otherwise incorporating a space, was tax deductible. Such taxation write-offs are available and certainly will end up being beneficial in this new coming.

Mortgage Obligations Isn’t really Crappy Obligations

Home https://simplycashadvance.net/loans/ivf-loans/ loan debt has actually typically already been felt a financial obligation for the majority of reasons. A home loan is frequently always create money with the help of household security, finance retirement membership, and commence companies.