Promote Proof of Income

To help expand ensure your revenue, be prepared to feel asked for in depth bank comments and shell out stubs. Lenders need to know your pay volume, plus the count you will be making. These types of monetary documents can help give research you have got a strong income collection and can deal with the larger loans weight off good jumbo mortgage. Any loans in Lake Bungee other records which can help be certain that your earnings, like prior invoices otherwise agreements, are advantageous to offer.

Reduce your Obligations in order to Earnings Ratio

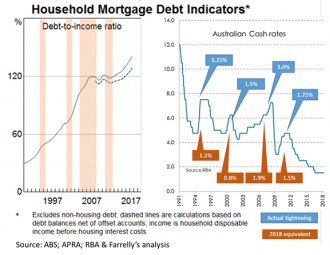

Outside fico scores, the debt-to-money proportion (DTI) is probably the very first figure loan providers want to see whenever provided jumbo home loans. Which profile, that’s provided during the commission means, ‘s the amount of cash you bring in compared to count you borrowed. Like, if you make $10,000 a month and you may owe $dos,five-hundred a month with debt payments, the debt to earnings proportion was twenty-five%. Loan providers believe a lower DTI to be safer than just an excellent large one to.

While decreasing your debt is one way to lower this new DTI, you’ll be able to increase your recorded income with levels such as IRAs, funding accounts and you may 401(k) profile. Whenever you are such accounts was handled in different ways because of the character from jumbo finance, they could reveal lenders you have available information to aid support huge mortgage payments.

When credit considerable amounts away from capital, financial institutions want to see too much cash in your coupons membership. It reserve dollars brings lenders greater encouragement that you aren’t just financially in charge, in addition to that one may manage your own home loan repayments for many who feel a decline inside money for any reason. Most lenders like to see around half dozen months’ worth of mortgage (and other obligations) costs into the reserve. However, when referring to a lesser credit score for a great jumbo loan, loan providers may need an entire year’s worth of offers. Definitely, any reserve bucks must be and an advance payment, settlement costs, and other appropriate fees.

Check out Adjustable Rates Mortgage loans

Sometimes, changeable rates mortgage loans (or Sleeve loans), are the most effective choice for you and the lender. Adjustable rates mortgage loans normally sustain particular monetary suspicion, however, rate of interest improve amounts are capped to be able to end big ballooning any kind of time part. If you wish to see a beneficial jumbo financing which have a credit score below 700, Sleeve financing could help you obtain the mortgage you would like whenever you are adhering to your own monthly financial conditions.

Get the very best Jumbo Home loan Pricing into the California

No matter what an individual’s credit score, North park Pick Funds is actually dedicated to bringing the customers the fresh most useful jumbo financial rates into the California and you will nationwide. If you’re looking so you can secure an excellent jumbo financing in check to to purchase the home of their hopes and dreams, we would like to help make your fantasy possible.

Together, we could make it easier to obtain accurate information on affordable financial support to possess your residence, in addition to most of the offered jumbo mortgage apps you be eligible for. We strive to truly get you a knowledgeable jumbo mortgage pricing when you find yourself adhering to the coverage off common-feel underwriting. Contact us today and you may help our team out-of gurus make it easier to find the correct financing into the right words…. so you can find the family you are going to like coming domestic in order to for many years to come!

Most of the time, a couple of years of tax returns is among the regular jumbo mortgage standards. But not, sometimes (such as for example which have an excellent credit score) a loan provider will accept just one year’s worth of monetary guidance. Which have a lesser credit rating having an effective jumbo loan programs, it is practically protected you will you need 2 years away from tax statements to greatly help be certain that your revenue.