While looking to home financing, some concerns may sound quite quick but it is always an effective to start with the basic principles then enter the facts. Here are a few issues should consider if you’re shopping for a home loan financial.

step 1. Do you trust their lender?

As if you manage meticulously like friends, of the skills the habits, activities, members of the family background, an such like., the new history of your own lender is essential to the bring about. As it’s a lengthy-name association, perform see information eg how long enjoys they been in the firm, are they known for getting ethical and you can elite group and you can what exactly is the common customers they solution? Methods to this type of questions allows you to shortlist the loan provider quicker.

dos. What is the loan eligibility?

A flash rule to remember is the fact traditional financial institutions could have stricter qualification criteria while you are casing boat finance companies (HFCs) / non-financial financial institutions (NBFCs) might possibly be a little alot more versatile. A bank only will look at your income proofs and you may already been up with a qualification, although some might gather more information regarding the lifestyle criteria, side money, following expenses, an such like., knowing your cost strength. Naturally, a more comprehensive analysis has a tendency to favour you which have a top mortgage eligibility and you will a top mortgage-to-value proportion ( LTV ratio ). You could potentially surf the web based and look your loan qualifications having 100 % free. This may as well as leave you a good suggestion just before officially using.

step 3. What’s the rate of interest?

Even if a lesser rate of interest is advised, you should know their genuine appeal outflow at the conclusion of your loan tenure. Including, take a look at if the considering interest rate are drifting or fixed . Usually, a dwindling floating rate is suitable on your go for.

cuatro. Are you willing to without difficulty build prepayments?

The best insights of any payday loans Foley online mortgage this new expanded the tenure, the higher the eye paid off! No matter what interest you’ve been provided, for people who find yourself using it to possess a very long time, its likely that the interest outflow will be really highest. The brand new smartest way to save cash is to close the funds early, either compliment of small however, regular prepayments or having a lump sum payment matter since prepayment. Ensure that you have the option away from prepayment for your home financing in the course of using the loan.

5. Will they be clear about their costs and you will fees design?

You should have so it on paper the particular charges and costs which will be levied for you regarding mortgage period, such as running fees, judge and technical costs, mortgage costs, property foreclosure fees, etcetera. When not ask about this type of before-going for a financial loan and have now restrict quality.

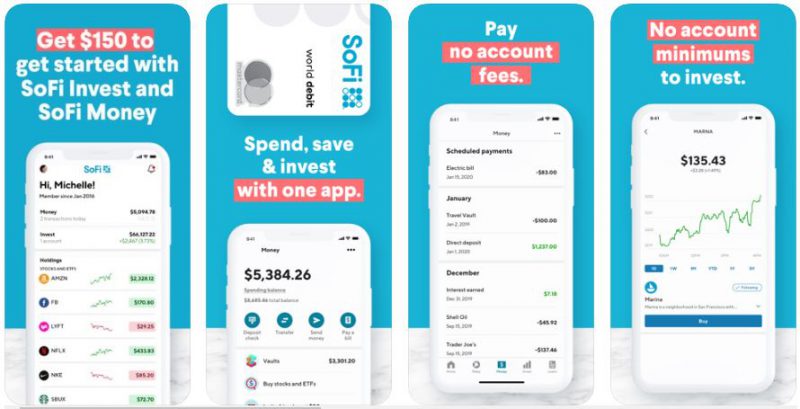

6. Are you presently taking digital accessibility?

Very companies are moving forward for the an electronic program on the convenience of the users. You need to be in a position to get your house financing effortlessly following, have a look at concerning loan out-of a cellular application. Features including paying your EMIs, bringing a statement away from membership otherwise increasing a query throughout the application are invaluable!

seven. Is the process trouble-free?

Formalities and you can records involved in financing process are very much important across the all the lenders on the market. Yet not, the latest approve big date can often vary by the weeks. The thus-named easy documentation’ isn’t that effortless! Like a lender which prides by themselves towards rate of the process. Ask for all criteria at once right after which begin to build your own band of documentation you can also choose an organisation whom trusts you over the new records you have.

8. Is it possible you get a single area off contact?

The bank will be able to cater to all your valuable need and you may from one section away from contact, and that means you do not have to run around.

nine. Try their mortgaged data files safer?

Your mortgaged documents are the claim to your home. Pose a question to your loan providers towards precautions they pursue into records, with the intention that paperwork will not end up being a frustration once you end up the mortgage tenure.

ten. Could you be taking mortgage insurance coverage?

Last not minimum of, safeguard your family off any unmatched disease. An insurance coverage to pay for your home loan is actually a secure route on the ambitions even although you commonly there so you can witness it. Very, it’s always advisable that you capture insurance and you will secure your own outstanding responsibility and make certain a safe upcoming and a threshold over your mind of loved ones.

Gaurav Mohta is the Master Selling Manager of your HomeFirst Fund. He or she is a mechanical professional and has done his post graduate degree in business management away from ICFAI Providers College, Hyderabad. He’s got more than 17 years of expertise in user funds, business and you may tool management. During the HomeFirst, they have already been instrumental from inside the installing sales shipping and you will developing the brand label of one’s company.