When you need to enter the mortgage industry, to-be that loan officer is going to be a good start. It is typically an admission-top business, but knowledgeable loan officials usually access the best efforts. If you want to learn how to getting that loan administrator, the newest measures are observed after in this article.

What is actually that loan manager?

Once you feel that loan officer, you will probably are employed in the borrowed funds industry. You are going to let someone submit an application for and be eligible for mortgages when to buy property. This can are examining the credit out of website subscribers or other affairs to make certain he’s qualified.

Action #1 installment loans online in Minnesota Wind up Senior school

You want a senior school education for people opportunity to become that loan administrator. Instead a high school degree or comparable, you’ll not manage to become that loan officer. That is in addition to the first faltering step towards the an effective bachelor’s studies, that will be very useful.

Action #dos Secure a good Bachelor’s Education (Optional)

Even though you won’t need to secure a good bachelor’s studies to become financing officer, it could be quite beneficial. A lot of companies require or at least like an effective bachelor’s degree inside the organization or funds due to their loan officials. On the other hand, you’ll likely need to complete courses during the accounting, statistics, finance, and you will mathematics.

You will need to assist clients with regards to application for the loan procedure, which means you need an excellent interaction event. Getting a few college or university programmes in public areas talking and you may telecommunications can also be end up being of use.

Action #step 3 Get some Jobs Experience

Companies regarding the financial business favor prior feel. Otherwise score a good bachelor’s studies, it will become alot more needed. Aspiring financing officials may start from the doing work in support service, conversion process, telemarketing, otherwise banking in advance of doing work doing become that loan officer.

Despite a great bachelor’s knowledge, they ple, you might have to begin in an entrance-top status otherwise at a smaller sized agency. Upcoming, you might work your way up to employment once the a great mortgage manager.

Step #4 Acquire On-The-Job Studies

Extremely mortgage brokers and you may financial institutions requires into-the-jobs education. At the same time, you may need to complete training getting lending options given by the firm you decide to work with. The training may differ, according to the kind of work environment and you will financial loans.

Together with studies concerning mortgage things given, you may need to see certain application. Usually, the software program is used to possess mortgage underwriting.

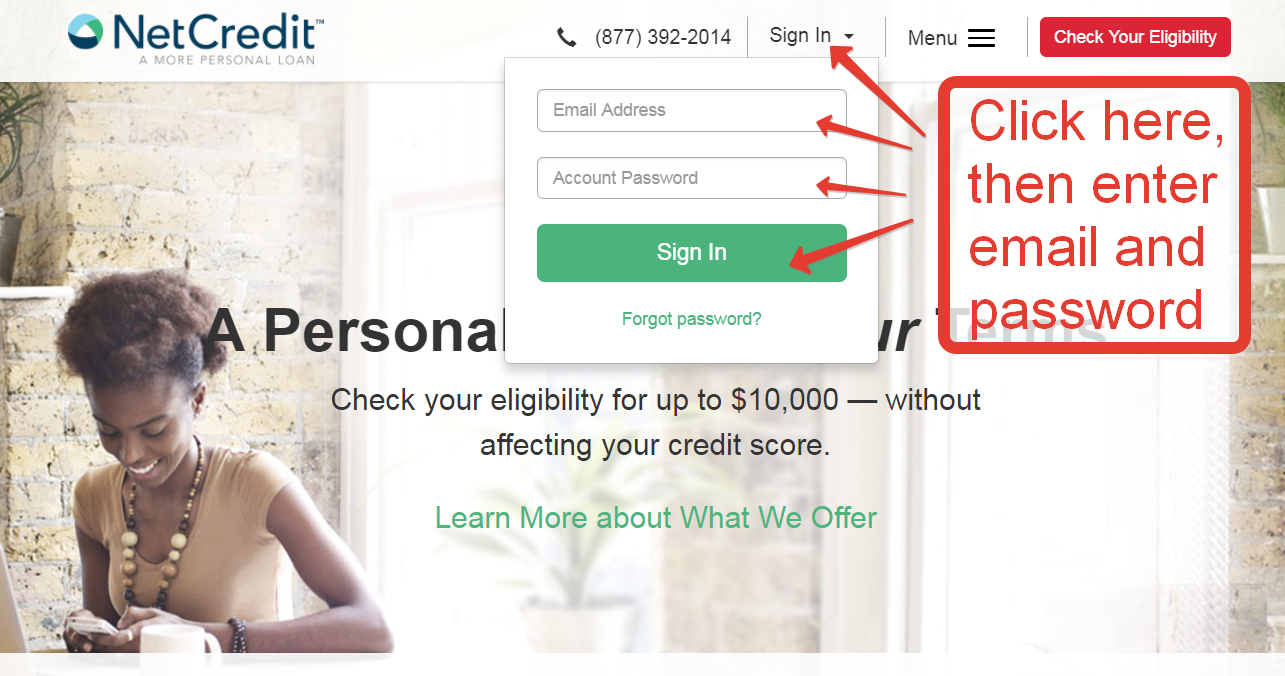

Step #5 Get your Mortgage loan Manager Licenses

Due to the fact an interest rate officer, just be sure to be an authorized mortgage loan creator. This may involve completing 20 days off coursework and you may passage the exam. you will need pass a background look at and you will a great credit score assessment.

For each county may have specific components on the MLO (Mortgage Administrator) exam. On the other hand, when you be registered, you will have to done persisted studies credit every year to replenish their permit. Usually, you’ll need 7 days of programmes each year, but it may differ by the county.

Step #six Obtain Experience

Financing officials don’t have to end up being specialized. But not, it assists your compete within really competitive career. As well, youSo in the event that can property one of the better mortgage officer ranks within more substantial agency toward best qualifications.

- Official Trust and Monetary Advisor

- Specialized Financial Selling Elite group

- Specialized Lender Team Banker

These certifications come from the loan Lenders Connection and the Western Lenders Association. These associations promote several options, along with executive, master, industrial, and you will home-based software. Try to complete the necessary requirements and you may admission the fresh new proper exam.