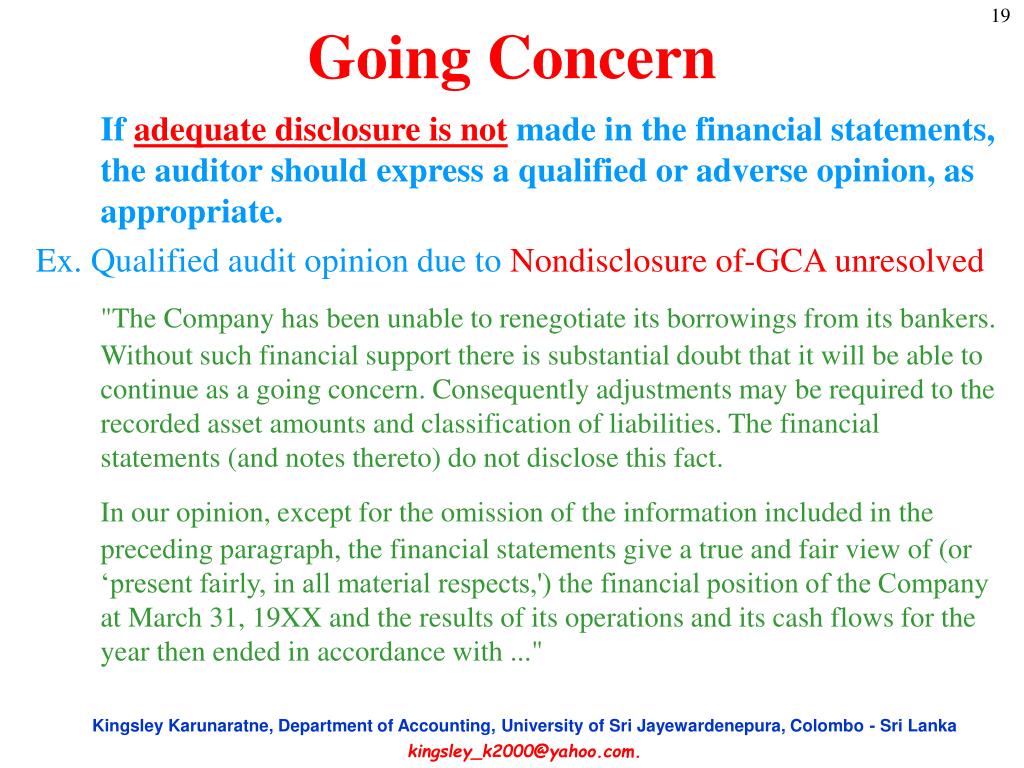

In both cases a paragraph explaining the basis for the qualified or adverse opinion will be included after the opinion paragraph and the opinion paragraph will be qualified ‘except for’ or express an adverse opinion. Candidates should generate the audit procedures specifically from information contained in the scenario to demonstrate application skills Jasmine Co in the September/December 2018 Sample exam demonstrates this approach. BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. Although US GAAP is more prescriptive than IFRS Standards, we would also expect under IFRS Standards that management plans are achievable and realistic, timely and sufficient to address the going concern uncertainties. The going concern concept or going concern assumption states that businesses should be treated as if they will continue to operate indefinitely or at least long enough to accomplish their objectives. In other words, the going concern concept assumes that businesses will have a long life and not close or be sold in the immediate future.

Going Concern Concept FAQs

This question is asked mainly when we talk about the roles and responsibilities of management and auditor related to going concerns of the company, and to answer this question, we should refer to the audit standard ISA 570. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free. The auditor should not only consider the intent of the supporting parties but the ability as well.

The Future of AI Is Now. Is Tax Ready?

If a company receives a negative audit and may not be a going concern, there are several implications. Companies that are not a going concern represent a significantly higher level of risk compared to other companies. In order for a company to be a going concern, it usually needs to be able to operate with a significant debt restructuring or massive financing overhaul. Therefore, it may be noted that companies that are not a going concern may need external financing, restructuring, asset liquidation, or be acquired by a more profitable entity. Going concern is an example of conservatism where entities must take a less aggressive approach to financial reporting.

The procedures to assess going concern

- If a company is not a going concern, that means there is risk the company may not survive the next 12 months.

- Disclosures are required if events and circumstances raise substantial doubt about the entity’s ability to continue as a going concern.

- In order to avoid the entity’s credit rating suffering any further decline, the directors have refused to make disclosures in the financial statements and have prepared the financial statements for the year ended 31 March 20X2 on the going concern basis.

- Management will need to monitor the expected impacts on operations, forecasted cash flows, and debt covenants, with the primary focus being on whether the company will have sufficient liquidity to meet its financial obligations as they fall due.

- IFRS Standards do not prescribe how management should evaluate its plans to mitigate the effects of these events or conditions in the going concern assessment.

The assumptions used in the going concern assessment should be consistent with those used in other areas of the company’s financial statements. FASB only requires the evaluation for the year following the date the financial statements are issued (or available to be issued, as applicable). Events following this one year period have no bearing on the current year going concern decisions.

Substantial doubt is raised and is not alleviated by management’s plans (substantial doubt exists)

– In the early 2000s, General Motors was experiencing great financial difficulties and was ready to declare bankruptcy and close operations all over the world. In normal circumstances, GM would not be considered a going concern, but since the Federal government stepped in, we have no reason to believe that GM will cease to operate. Going concern is important because it is a signal of trust about the longevity and future of a company. Without it, business would not offer nearly as much credit sales as suppliers, vendors, and other companies may not pay the company if there is little belief these companies will survive.

What Happens If a Company Is Not a Going Concern?

For example, under US GAAP, the look-forward period for a company with a December 31, 20X0 balance sheet date and financial statements issued on March 31, 20X1 is the 12-month period ended March 31, 20X2. US GAAP requires management’s plans to meet certain conditions to be considered in the assessment. This includes information known or reasonably knowable at the date the financial statements are issued (or available to be issued).

Companies with low liquidity ratios, high employee turnover, or decreasing market share are more likely to not be a going concern. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Then we should consider whether auditors put all possible procedures that should be performed or not. That means the quality of audit procedures is the place that should be questioned. Related to the going concern of the company, auditors are not responsible for assessing the going concern of the company.

KPMG explains how an entity’s management performs a going concern assessment and makes appropriate disclosures. Q&As, interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments. This latest edition includes illustrative application of going concern’s most significant complexities. When companies prepare their year-end financial statements1 under IFRS® Accounting Standards, disclosures around going concern are especially important to achieve transparency and provide users with relevant information. First, the auditor may conclude that management’s use of the going concern basis is inappropriate. This means that the financial statements are effectively rendered meaningless, and ISA 570 requires the auditor to express an adverse opinion on the financial statements.

It is important that candidates understand that it is the responsibility of management to make an assessment of whether the use of the going concern basis of accounting is appropriate, or not, when they are preparing the financial statements. US GAAP includes a what is the gift tax in 2020 two-step process that first determines whether substantial doubt about the company’s ability to continue as a going concern is raised. If substantial doubt is raised, management then assesses whether that substantial doubt is alleviated by management’s plans.

The audit firm should carefully consider the appropriateness of providing such non-audit services in these circumstances. Where risks, such as the ones mentioned above, have been identified, the auditor must respond to the risks by designing and performing appropriate audit procedures. Clearly the procedures should address the specific risks identified, and so extra procedures may be needed on many balances and transactions such as the ones outlined above. For example, if management said that the company is operating well, but auditors noted that the sales revenue is decreasing significantly. However, audits are responsible for reviewing the management assessment and considering if those assessments are in the line with their understanding or not.